7 Hacks for Stress-Free Payroll Management l ByteHR

Bonus:Download your free payroll processing checklist

Processing payroll in Malaysia can throw you into panic, not because you can’t put 1+1 together, but because there’s zero room for error.

One SOCSO miscalculation can trigger a domino effect that disrupts your entire payroll. Leaving you with angry employees, a need for recalculations and resubmissions, and possible regulatory violations.

Whether you are looking for the best payroll software in Malaysia or trying to improve your manual payroll management system, the challenges are the same. Things are constantly changing:

New hiring and termination

Regulatory changes

Salary adjustments,

Leaves and claims everywhere

It’s so easy to make mistakes.

Every month is like walking a tightrope. So, how do you manage payroll software for small business needs without losing your mind?

What has helped many people manage payroll without losing their minds?

👉Using a checklist.

Download your free payroll processing checklist.

Then read on to learn seven changes that can turn payroll periods from being dreaded to becoming just another day at the office.

This guide is for you, whether you want to run payroll for 10 or 100+ employees. Whether you run payroll manually or use payroll management software.

Here are the seven changes you need to make:

Centralise your data sources

Build a logical payroll checklist

Update yourself on statutory rates

Introduce a time tracking app for transparency

Switch to a payroll management software with true automation

Conduct a payroll audit

Update changes the moment they occur

Payroll compliance without the stressMost payroll solutions claim they’re “compliant,” but few keep up with Malaysia’s fast-changing rules. ByteHR goes beyond automation. It’s always updated to meet EPF, SOCSO, PCB, and EIS requirements, so you never risk penalties. ✅ Auto-updates for new laws & regulations 👉 Don’t gamble with compliance. Run payroll the right way with ByteHR. |

Change #1: Centralise your payroll data source

Best: If things change a lot in your company.

Requirement: A doc, folder, and/or spreadsheet.

Goal: Organise all the information you need in one place.

What you want to accomplish here is to ensure you have all the current and updated information on:

New hires with their start date and employment information

Each employee’s salary, claims, deductions, and any one-offs

Changes in employees' status (such as promotions, terminations, new titles, address changes, deductibles, etc.)

Any pay raise or deductions, refunds, or claims for the next payroll cycle

Anything that you need to process payroll

Plus a record of what execs and heads of department have requested you to do.

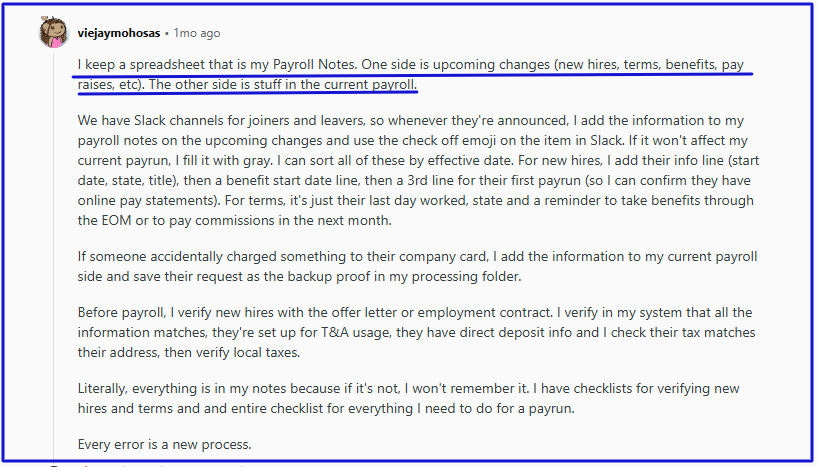

When you think about it, most of the mistakes we make in payroll management stem from misinformation, scattered information, or a lack of information.

So, putting everything in one place ensures you have all you need organised and accessible.

Here are three ways to centralise your payroll data.

1. Keep a folder

Maintain a folder containing all relevant documents, including email updates, forms, offer letters, employment contracts, termination letters, and any other file or communication related to employee payment.

2. Keep a doc

You can copy and paste emails or any piece of information you receive that may be too much for a spreadsheet cell.

3. Keep a spreadsheet

Add all the information you need for your next pay run into a spreadsheet. Organise them for sorting, easy retrieval, and maintenance.

You can take a cue from how this user on Reddit did it.

Change #2: Build a logical payroll checklist

Best: If there are many moving parts to your payroll processing

Requirement: A doc or spreadsheet

Goal: Remove the confusion about what to do next in your payroll processing

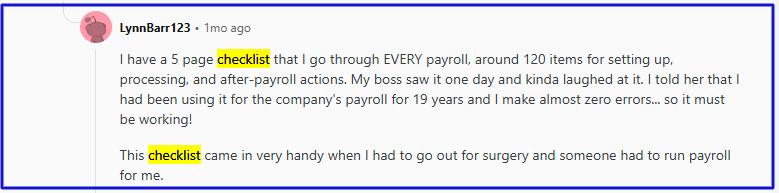

This is as simple as listing out the steps you need to follow before, during, and after each pay run.

This is in contrast to just following your instincts or experience. Here, you lay out what you do before and during your payroll run into a logical and sequential series of steps that ensure nothing slips through the cracks.

You can download your free payroll processing checklist to get started.

We often skip or mix up essential things when there are no clear steps to follow. Creating a step-by-step checklist of everything you need to do in a pay run will fix this.

Whether you use payroll software or do payroll manually, the key to an error-free payroll management is laying out the steps you need to follow.

Here's how to set up a payroll processing checklist.

Step 1: Fire up your Google Docs or spreadsheet and create two columns. The first column outlines the action you need to take, while the second column explains what it entails, the requirements, and how to take that action.

Step 2: Start filling it up with all the steps you need to follow.

Step 3: Organise the list into a sequential and logical flow from prepayroll, payroll, and postpayroll steps..

For example, your prepayroll checklist might include:

Review your payroll data sources for accuracy and completeness

Connect with heads of department to ensure nothing is missing

Review statutory deductions and labour laws for any updates

Your payroll checklist could include:

Calculate the deduction for employees

Reconcile OT and paid leaves

Enter information for new employees

What you have on your checklist depends on your industry, your team, and your payroll needs.

Your checklist can be as long as it needs to be to meet your payroll needs. Also, every error you encounter becomes a new entry into your checklist.

Change #3: Stay in touch with regulatory changes

Best: If you run payroll manually

Requirement: Internet access

Goal: To ensure your payroll is compliant with any regulatory changes

If you haven’t been closely monitoring the labour and payroll regulations in Malaysia, you should.

Why?

Ignorance is not an excuse before the law.

Imagine processing payroll for February 2025, unaware that as of February 1, 2025, the minimum wage has increased from RM 1500 to RM 1700 for companies with more than 5 employees.

Also, imagine processing payroll for August 2025, not knowing that as of August of the same year, the minimum wage requirement goes across the board for every business.

There are also constant changes to regulations regarding leaves, overtime, and working hours. The only way to run a compliant and error-free payroll is to always stay current on labour laws in Malaysia.

Here are the sites you can visit to stay updated on any changes:

Ministry of Human Resources (MOHR): https://www.mohr.gov.my/

Employees Provident Fund (KWSP/EPF): https://www.kwsp.gov.my/

Social Security Organisation (SOCSO/PERKESO): https://www.perkeso.gov.my/

Inland Revenue Board of Malaysia (LHDN): https://www.hasil.gov.my/

- Department of Labour Peninsular Malaysia (JTKSM): http://jtksm.mohr.gov.my/en/home

This is one reason many SMEs move from manual payroll to payroll software Malaysia solutions that automatically apply updated statutory rates.

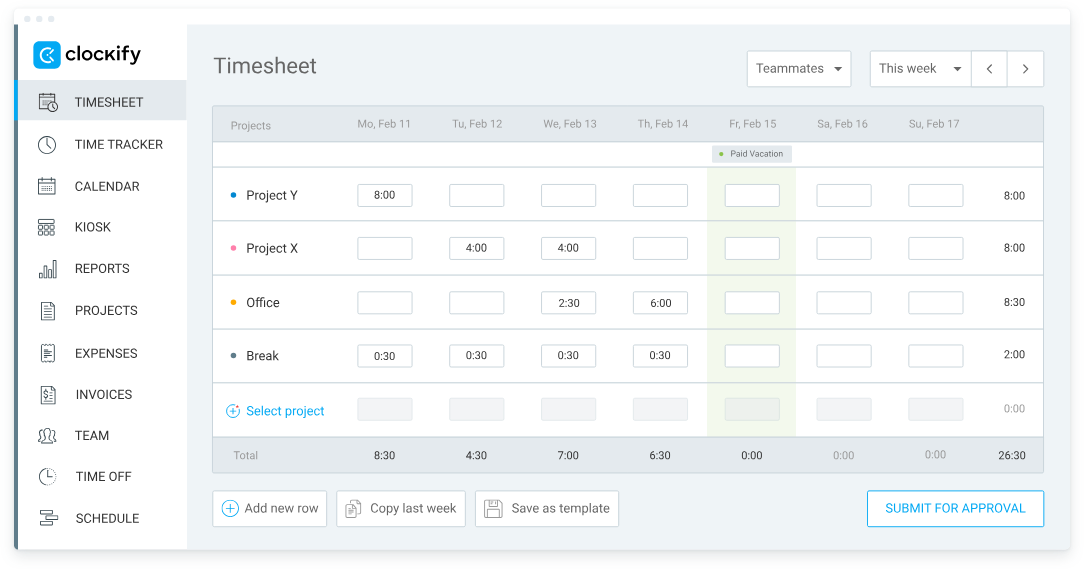

Change #4: Introduce a time tracking app for transparency

Best: If you pay per hour or run multiple shifts

Requirement: A time tracking app

Goal: To ensure transparency and eliminate the need for manual timesheets.

Manually tracking shifts and hours can result in numerous errors and disputes with employees. Additionally, monitoring sign-in times, breaks, sign-outs, overtime, and other details can be stressful.

By tracking sign-ins, sign-outs, logged hours, shifts, and providing an auto-updated timesheet for your payroll processing, a time tracking solution automates this process, eliminating errors in accurate payment that stem from mistakes in time tracking.

You can use a standalone time tracking app that integrates into your payroll software or a payroll solution that provides automated time tracking.

Many HR payroll systems in Malaysia now include built-in time and attendance features, removing the need for separate tools.

Change #5: Switch to a payroll software for true automation

Best: If you manage more than five employees

Requirement: A payroll software within your budget

Goal: Eliminate the mistakes and stress of compliant payroll processing

Especially if you manage a large and growing team, many mistakes can go unnoticed. This leads to errors, stress from trying to chase to fix them, angry employees, and possible violation penalties.

A payroll automation software, like ByteHR, automates every aspect of your payroll processing:

Time and leave tracking

Salary calculation and statutory deduction

Automatic compliance with accurate statutory deductions

Payslip generation and distribution

Filling and submitting government forms

Analytics and reports

Integration with HR software to process payroll with updated employee info

An employee self-service app to access their payslips and personal information

Easy to use for non-HR or accounting people

Switching to a payroll software that offers true and accurate automation, integrates with or provides HR modules and provides all the help and support you need can fix all your payroll woes. Removing all the stress and errors in your payroll processing.

ByteHR is an HR+payroll software for startups and small businesses in Malaysia that provides all the benefits of using a payroll software and the best customer support you can find in Southeast Asia.

See these customer reviews on Google.

|  |

Check out our guide on the best payroll software in Malaysia and choose the solution that meets your business’s needs.

Some platforms even offer free payroll software Malaysia plans with limited functionality, which may work for very small teams but often lack full compliance and automation.

If you don’t want to go through the trouble of reading a long article to choose, check out ByteHR. ByteHR is designed for SMEs in Malaysia and offers all the tools you need for a compliant and stress-free payroll process with the best customer support in the whole of ASEAN.

Book a demo to learn how ByteHR can help you process payroll without stress or errors.

Change #6: Conduct a payroll audit

Best: If you manage a large team with different pay cycles/periods

Requirement: Google Docs or a spreadsheet

Goal: to dot every I’s and cross every T’s

Sometimes, even after working with a preparyroll and payroll checklist, some things still fall through the cracks. That is where a regular post-payroll audit comes in.

A payroll audit will enable you to identify mistakes and prevent their recurrence in the future.

To set up an audit checklist, open a spreadsheet or document and start writing down the items you need to review after payroll.

It can include:

Check that all payslips are generated and distributed

Check new hires and terms

Review OT and leaves

Check to ensure all salaries are sent out

Confirm that all changes are updated

Any mistake you find in your audit becomes an entry in your usual payroll checklist.

Change #7: Update changes the moment they occur

This is more like a bonus.

If a lot of changes happen in your company, it may be better to update your payroll system as they happen, instead of waiting till payroll week.

Why?

It ensures you’re always current, avoids any oversight, and buys you a lot of time when payroll week finally comes.

What are the regulations you need to know and comply with in Malaysia?

The labour laws in Malaysia are built on the Employment Act 1955. This act stipulated the following:

Working conditions

Wages

Leave

Overtime pay

Minimum wage

Maximum work hours

Among others.

Over the years, this act has been amended to meet current needs.

For payroll, here are the key regulations you must know and comply with in Malaysia.

- Employment Act of 1995 (as amended)

- EPF Act of 1991 (as amended)

- SOCSO Act of 1961 (as amended)

- EIS Act of 2017

Keeping up manually is difficult. This is why many SMEs adopt a payroll system Malaysian businesses can rely on for automatic compliance.

ByteHR makes payroll processing stress-free and error-free

Most payroll solutions in Malaysia claim to be “compliant,” but few actually keep up with Malaysia’s fast-changing rules.

ByteHR is always updated to meet EPF, SOCSO, PCB, and EIS requirements, so you never risk penalties.

✅ Auto-updates for new laws & regulations

✅ Payroll, leave & attendance in one system

✅ Employee self-service with ePayslips & check-ins

✅ Responsive local support team

👉 Don’t gamble with compliance. Run payroll the right way with ByteHR.

Book a demo to see how ByteHR suits your business's payroll needs.

Frequently Asked Questions About Processing Payroll in Malaysia

What are the main things I need to settle monthly & yearly for tax/compliance?

Accurate salary, OT, claims, and leave calculation

Accurate statutory deduction

Payslip generation

Generating and submitting tax forms

Discover 12 government tax incentives available for SMEs in Malaysia.

Do most small biz owners do payroll themselves, or better just to use software?

According to conversations on Reddit and Facebook, many small businesses process payroll manually. Due to the errors they frequently encounter, several SMEs are considering transitioning to payroll software for the first time to achieve true automation and regulatory compliance.

When should I start getting ready for the annual tax filing? Like, how early to prepare?

You should prepare for annual tax filing from every pay run. If you avoid errors in every pay run, you’ll be ready for every and any annual tax filing.

How can I minimise errors in payroll processing in Malaysia?

Set up a pre, during, and post-payroll checklist

Switch to using payroll software

Introduce a time tracking automation software

Make changes as they occur

Ensure you’re updated on current regulation changes

Create a centralised source of data for your payroll

What are the most common payroll errors SMEs make, and how do I prevent them?

Not updating a new hire or processing a terminated employee

Incorrect salary rates for new employees

Inaccurate SOCSO, EPF and EIS deductions for new employees

Missing tax deduction

Over time, shifts and leave miscalculation

Check out the seven costly mistakes SMEs make.

Can payroll software guarantee accurate EPF, SOCSO, PCB, and EIS deductions?

Yes.

Payroll software like ByteHR provides accurate statutory deductions with the current regulations and requirements.

How do I reduce manual errors when calculating overtime or allowances?

Use payroll software that integrates time tracking, leave and claim management

Keep a centralised source of data for your payroll processing

Make changes when they occur

What’s the easiest way to stay compliant with Malaysia’s payroll regulations?

Stay updated with regulatory changes

Use a payroll automation software that offers true automation and accurate statutory deductions.

How do I make sure my payroll reports meet LHDN requirements?

Stay updated with regulatory changes

Use a payroll software that offers true automation and accurate statutory deductions.

Can payroll software automatically generate statutory forms (EA, CP22, CP22A)?

Yes.

Payroll software like ByteHR can automatically generate and submit statutory forms to enable employees to file their taxes.

How do I avoid penalties from LHDN for late or inaccurate submissions?

The easiest way to avoid late or inaccurate submissions is by following the recommendations in this guide and using software that automates the process.

What’s the best way to simplify payroll so it doesn’t eat up so much time?

Gather all the data you need to process payroll

Use a checklist to ensure you follow all the correct steps and do not miss anything

Use payroll software that automates everything

How do I manage payroll for multiple locations or branches without stress?

Gather all the data you need to process payroll

Use a checklist to ensure you follow all the correct steps and do not miss anything

Use payroll software that automates everything and provides compliance with regulations in different locations, and supports multiple currencies. Also, use payroll software that allows for multiple user collaborations.

Can payroll software help with leave, overtime, and attendance all in one place?

Yes.

ByteHR provides HR + payroll modules that handle and manage leave, OT, and attendance all in one place.

What is the best payroll software in Malaysia to reduce errors?

ByteHR is the best payroll software in Malaysia to reduce errors and stress for small businesses.

ByteHr provides:

A simple UI to make it easy to use

HR + payroll modules in one place

Customer support that’s accessible (responds in 60 seconds) and helpful

Automated statutory compliance

How do I choose between outsourcing payroll vs using software?

If you manage a large team but do not have or don’t want to hire a payroll or HR team, outsourcing payroll may be the best option for you. On the other hand, if your team is small or you have an HR team, adopting payroll software like ByteHR can be your best route of action.

Check out our guide to choosing a payroll outsource partner.

Can payroll software integrate with my accounting system or time tracking tool?

Yes.

Most payroll software, like ByteHR, either has time tracking and native bank integration or integrates with accounting software like Xero and QuickBooks.