7 Costly Payroll Mistakes in Malaysia That Could Get You Fined (And How to Avoid Them)

Bonus: Grab your payroll processing compliance checklist

One of these happens when you make mistakes in processing payroll:

Employees screaming at you

Spending an entire day apologising

Possible penalties from LHDN

Sometimes, these payroll mistakes are not your fault. Other times, they’re because you forgot to do something, or did it wrong.

In my last article, I shared seven changes you can make today to make the payroll process error-free and stress-free.

Today, I want to share the seven mistakes you need to avoid that usually lead to employees screaming at you by 12 midnight.

Download your payroll processing compliance checklist.

Then read on to uncover the costly payroll mistakes businesses still make, what causes them, and exactly how to avoid them.

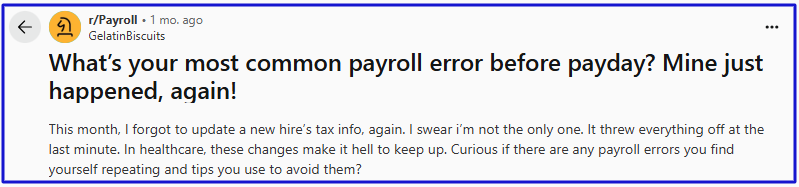

How did I gather this information?

From payroll managers, HR managers, and managers like you on Reddit.

Let’s go!

Here are the seven mistakes you should avoid.

Failing to update new hires’ info

Continuously paying terminated employees

Incorrect salaries or rates of pay

Too many cooks

Inaccurate PTO, OT & leave payment

Miscalculating statutory deductions

Using outdated payroll software

Payroll processing without errors!Most payroll solutions claim they’re “compliant,” but few keep up with Malaysia’s fast-changing rules. ByteHR goes beyond automation. It’s always updated to meet EPF, SOCSO, PCB, and EIS requirements, so you never risk penalties. ✅ Auto-updates for new laws & regulations 👉 Don’t gamble with compliance. Run payroll the right way with ByteHR. |

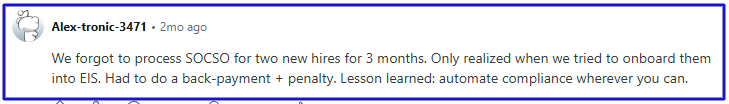

Payroll mistake #1 - Failing to update new hires’ info

This is a common payroll mistake made by many accountants and payroll managers.

A new employee joins the team, and they fail to:

Update their status on their HR tool

Add them to the correct employment category

Add them to your payroll with the right ID, SOCSO, tax, and EPF info

What causes this mistake?

Oversight and using a payroll system that’s not integrated with your HR and employee management system. Another common cause is manually managing payroll.

A disjointed or manual payroll system requires you to enter every employee manually. When you run payroll manually, you’re likely to make mistakes.

What does this mistake lead to?

When new hires are improperly entered, they’re either not paid at all or are not paid correctly.

Additionally, their statutory deduction may be incorrect, their tax may be miscalculated, and they may not have the correct payslip and forms generated and submitted.

When this happens, you may have to do a lot of back payments and possibly face penalties. In addition to whatever you’ll get from your employee and the bosses upstairs.

What law are you violating with this mistake?

The results of failing to update new hires’ information lead to violations of these labour laws in Malaysia:

Employment Act 1955: Requires employees to be paid correctly within seven days after the end of the work period.

EPF Act 1991: Requires employers to register new employees with the EPF within seven days of employment. In addition to providing an accurate salary statement to employees.

SOCSO Act 1969: Requires employers to register employees within seven days of commencement of employment.

- The EPF and SOCSO Act: Requires employers to deduct and pay EPF and SOCSO contributions for employees.

What are the penalties for this mistake?

Failure to register new employees with EPF on time can lead to a fine of up to RM10,000, imprisonment of up to 3 years, or both.

Failure to register new employees with SOCSO on time and remitting the required contribution can result in fines of up to RM50,000.

Failure to generate and distribute accurate payslips for employees can lead to a fine of up to RM 2,000, up to six months imprisonment or both.

How can you avoid making this mistake?

There are two effective approaches to avoiding this mistake.

Using a prepayroll checklist ensures that new hires are accurately recorded with the correct information. Download your checklist here.

- Using a payroll software that integrates with or has a native HR module, like ByteHR. This automates the salary and statutory deduction calculation, remitting of deductions, generating and distributing payslips, as well as tax forms for new hires.

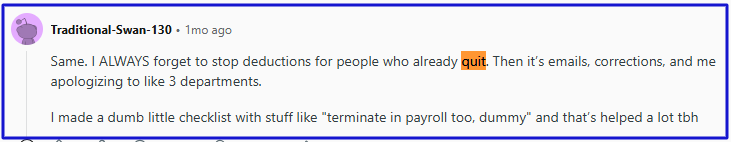

Payroll mistake #2 - Continuously paying terminated employees

An employee leaves your company but continues to receive pay because you forgot to remove them from your payroll.

Some payroll managers or accountants still make this mistake.

What causes this payroll mistake?

Using HR systems in silo from your payroll system. So when an employee leaves, your payroll is not automatically updated.

Lack of communication between HR, accounting, and all the departments in your organisation.

No central source of data for your pay runs.

What does this mistake lead to?

There’s no major legal violation for this mistake. The only problem is that your company pays for services that will not be rendered.

Just some nice charity work.

And you have to explain to execs and accounting why they’re paying for a ghost worker when it comes time for auditing.

How can you avoid making this mistake?

Follow my recommendation in our guide on the seven changes to make payroll processing stress-free and error-free, and maintain a central source of data for your pay run.

You can use a spreadsheet, folder, or Word document to keep a record of every change in your organisation. So when it comes time for payroll processing, you have a central place with all the changes and updates you need to make.

The second recommendation is to create a payroll checklist with “Update terminated employees” as one of the items.

This can remind you to review your documents for information on terminated employees, reach out to HR to confirm, or follow up with each department to understand the status of their team members.

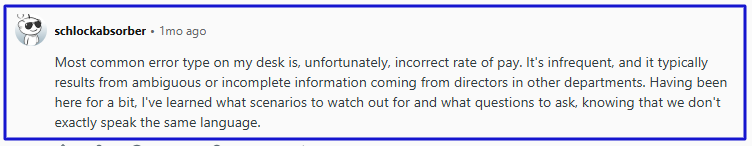

Payroll mistake #3 - Incorrect salaries or rate of pay

This is as the word implies. You transfer salaries, but employees complain that they’re underpaid.

What causes this mistake?

Miscategorising employees

Incorrect timesheets

Incomplete information from departments

What does this mistake lead to?

The first consequence of not paying your employees correctly is employees ringing your phone, sending you angry emails, or lighting up your DMs.

And if it happens to more than one person. You have a new payroll to process and some explanation to make.

If this is a mistake of commission that is not in violation of the minimum wage requirement, there may not be a legal issue related to it. You may just have to redo the payroll for affected employees.

How can you avoid making this mistake?

Gathering accurate information about each employee from their employment letter to their contract, so you can properly categorise them.

Reviewing work timesheets line by line to ensure employees' hours are correctly recorded.

Using an HRMS software like ByteHR, which combines HR, Payroll, and time management, helps to avoid these mistakes.

An HRMS solution like ByteHR, which integrates HR, payroll, and time management, ensures that employee records are created, feeds payroll with the correct employee wage rate, and supplies correct timesheets for payroll processing.

Payroll mistake #4 - Too many cooks

What does too many cooks do?

You got it right, they spoil the broth.

In some organisations, a whole village is involved in payroll processing. Everyone from the CEO to the department heads to the accountants.

By involved, we don’t mean being stakeholders; we mean directly editing and altering timesheets, payroll sheets, or the dashboard and other aspects of your payroll.

What causes this mistake?

Most of the time, it is due to a lack of a dedicated accountant or HR manager. Other times, it is a lack of clear-cut roles and operational procedures.

What does this mistake lead to?

Every error in the payroll processing books can occur when too many people are actively editing your payroll.

Errors such as:

Inaccurate salary and rates

Inaccurate deductions and remittance

No one person to hold accountable for payroll

All of these can lead to violations and possible penalties.

How can you avoid making this mistake?

Have a person or department in charge of payroll

Payroll mistake #5 - Inaccurate PTO, OT & leave payment

Malaysian labour laws protect employees' right to paid time off (PTO) and overtime payment (OT).

It is common to miscalculate employees' PTO and overtime.

What causes this mistake?

Inaccurate timesheets can lead to inaccurate OT payment

Lack of info from departments on the leave status of each employee

Using the wrong OT rate

What does this mistake lead to?

Disappointed employees and running payroll again to fix a mistake.

What law are you violating with this mistake?

The Employment Act 1955 gives every employee the right to be paid at least 1.5 times to 3 times their normal hourly rates for OT. Depending on the type of OT

The Employment Act 1955 entitles every employee to at least eight paid days off per year. Depending on the nature of the employment (part-time or full-time) and the nature of the leave (sick, annual, maternity, etc), this number can get up to 98 days per year.

What is the penalty for this mistake?

Violation of the regulation on OT and PTO payment can lead to fines of up to RM50,000.

Ongoing violations can attract a daily fine not exceeding RM1,000 for each day the violation continues after the first conviction.

How can you avoid making this mistake?

Add “review the updates on labour laws on OT and PTO” to your prepayroll checklist. This will enable you to ensure your payroll does not violate OT and PTO regulations

Add “Review OT timesheet” to your prepayroll checklist to ensure you’re paying your employees the correct OT payment for the hours and type of OT they worked.

Add “Review employees' leave status” to your payroll checklist to ensure you have the correct information on employees' leaves taken.

Use HRMS software, like ByteHR, that integrates HR + Leave + Overtime + Payroll in one. This enables automated updates on PTO and leaves.

Add “get updated info on approved OT” to your prepayroll checklist to ensure all OT has been approved and nothing is slipping through the cracks.

Grab your free payroll checklist.

Payroll mistake 6 - Miscalculating statutory deductions

Sometimes, you can make the wrong EPF, SOCSO, EIS, and tax deductions and give employees a lower or higher net pay.

What causes this mistake?

Using the wrong EPF, SOCSO, EIS, and PCB rates

Manually calculating statutory deductions. Manual calculations are prone to errors, especially when processing payroll for a large number of employees

What does this mistake lead to?

Disappointed employees can lead to disappointed leaders, resulting in the need to handle multiple emails, calls, and rerunning payroll.

Violation of statutory regulations and possible penalties

What law are you violating with this mistake?

The Employees Provident Fund (EPF) Act 1991 mandates accurate deduction and remittance of EPF contributions for both employee and employer.

The Employees' Social Security (SOCSO) Act 1969 mandates accurate deduction and remittance of SOCSO contributions for both employee and employer.

The Employment Insurance System (EIS) Act 2017 mandates accurate EIS deduction and remittance.

Income Tax Act 1967 (Monthly Tax Deduction/PCB) mandates accurate tax deduction and remittance.

What is the penalty for this mistake?

Fines of up to RM50,000

How can you avoid making this mistake?

Create a payroll checklist or reminder to use the correct deduction rate for employer and employee statutory deductions

Review payroll slips for each employee before making transfers

Use a payroll software, like ByteHR, that automatically deducts statutory deductions and generates payslips for each employee

Payroll mistake #7 - Using outdated payroll software

The greatest problem with payroll processing is the system you use. Manual processes, such as using a spreadsheet or outdated payroll software, lead to all the issues in the book.

What causes this mistake?

Reluctance to transition from a spreadsheet or old software to new, modern software

The work required in the transition can be a lot

New software can be expensive

Ignorance of available modern automation tools for payroll

Discover the top payroll software in Malaysia.

What does this mistake lead to?

Inaccurate calculation of salaries, deductions, and other statutory-mandated pay

Disatisfied and venting employees

Violation of statutory requirements and possible penalties.

How can you avoid making this mistake?

Switch to a modern, automated, and comprehensive HR + payroll software like ByteHR.

ByteHR is a comprehensive payroll software with HR, leave, claims and time management modules integrated with a mobile app for employee self-service (ESS).

With ByteHR, you can:

Automate accurate salary and statutory deduction calculation, deduction and payment.

Generate payslips for employees to access via a mobile app.

Integrate leave, time tracking and claims to sync all employee details for an accurate salary calculator automatically.

Customer support that’s helpful and accessible.

Book a demo to see how ByteHR can help avoid mistakes and stress in payroll processing.

Frequently Asked Questions About Payroll Mistakes in Malaysia

What payroll compliance mistakes lead to fines in Malaysia?

Every mistake that results in not paying employees or paying them late, miscalculating statutory deductions, or not remitting everything that was deducted leads to penalties, fines, and sometimes imprisonment.

How do I avoid errors with EPF, SOCSO, EIS, and PCB contributions?

Create a payroll checklist or reminder to use the correct deduction rate for employer and employee statutory deductions

Review the payroll slips for each employee before making money transfers

Use a payroll software, like ByteHR, that automatically deducts statutory deductions using the current updated rates and generates payslips for each employee.

What happens if I miss the LHDN submission deadline?

Missing the LHDN submission can lead to one-time fines and daily fines if it continues after the conviction.

Can I get penalised for miscalculating overtime or public holiday pay?

Yes.

Miscalculating OT and public holiday pay violates the Employment Act of 1955 and can lead to fines.

How do I make sure I’m following the Employment Act 1955 in payroll?

Read the document to understand it, or look for resources that discuss the main point of the Act that relates to payroll

Create a checklist to help you implement all the Act's requirements in your payroll.

Use payroll software that helps you automate the deduction and statutory forms generation, and submission

What are the costliest or worst payroll mistakes SMEs make?

It’s mostly miscategorising employees and inaccurate OT and PTO calculations. This leads to inaccurate and unfair wages. This can lead to a violation of the Employment Act of 1955, which can attract penalties.

How do I prevent paying employees late or the wrong amount?

The best way is to use payroll software like ByteHR, which helps automate salary calculations and deductions, employee transfers, and government remittance.

How do I double-check payroll accuracy without wasting hours?

Creating a post-payroll checklist is the best way to do this. Check out our payroll checklist for ideas.

What payroll mistakes cause employees to lose trust in HR?

Miscalculating overtime and PTO. This mistake makes employee feel their efforts are not recognised and may make them lose trust in HR and the entire organisation.

How do I avoid mistakes that delay payslips or bonuses?

The best way is to use payroll software like ByteHR, which helps automate salary calculations and deductions, employee transfers, and government remittance.

Disclaimer.

The information we provided in this guide is for general informational purposes only. While we strived for accuracy and timeliness, Malaysian labour laws and compliance requirements may change over time. Readers are advised to independently verify any critical information and should not solely rely on the content provided here to make decisions.